In today’s hyper-competitive digital retail environment, access to fast and flexible capital can mean the difference between scaling your store and missing key growth opportunities. Whether you're a DTC brand selling through Shopify, a reseller on Amazon, or a new dropshipping startup, ecommerce business funding can help bridge the gap between ambition and execution.This comprehensive guide breaks down the top funding options available in 2025, compares them to traditional loans, reviews leading e-commerce lenders (with direct links), and explains exactly how to qualify for the funding your store needs.

E-commerce business funding refers to financial products specifically tailored to the operational needs of an online store loans. Unlike general-purpose business loans, these funding options are specifically designed for e-commerce models, where digital cash flow cycles, high inventory turnover, and platform-based sales data are the norm.Why Ecommerce-Specific Funding Matters:

Every day, ecommerce financing needs include:

Whether you're seeking startup capital or need quick working capital, ecommerce-specific funding offers speed, accessibility, and terms aligned with digital business realities.

Let’s explore the most effective funding solutions available to e-commerce entrepreneurs this year. These are not generic loans—they're designed for fast-growing, online-first businesses.

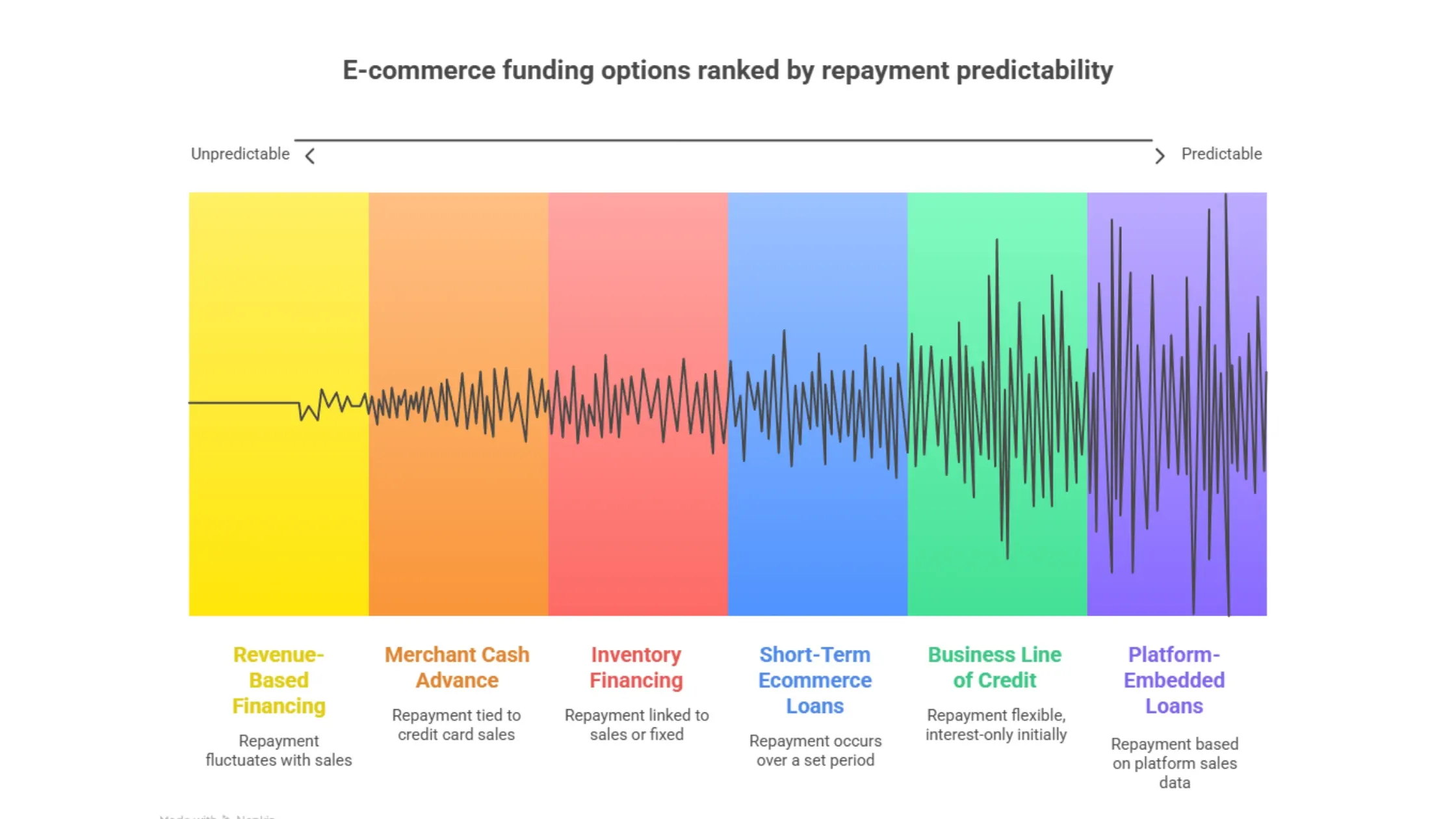

Revenue-based financing allows you to borrow capital in exchange for a fixed percentage of your future revenue. It’s ideal for stores with stable monthly sales but unpredictable seasonal swings.

This type of loan helps you finance the purchase of inventory before you generate revenue from the sale of those items. It’s perfect for brands preparing for major seasonal pushes or bulk restocks.

An MCA gives you a lump sum based on projected credit card sales. It’s fast, unsecured, and easy to obtain—but can be expensive if not managed wisely.

Short-term business loans specifically designed for e-commerce stores can be utilized for advertising campaigns, software purchases, product testing, or addressing seasonal needs.

An LOC gives you access to a revolving pool of funds that you can draw from anytime. Think of it as a safety net to cover unexpected expenses or scale initiatives when needed.

These loans are offered directly within the platforms you sell on, making them highly convenient.

Traditional small business loans have long been a go-to, but they often fall short for e-commerce brands that operate without a storefront or physical equipment.FeatureE-commerce Business LoanTraditional Business LoanApproval Time1–3 days2–6 weeksRequirementsRevenue, platform dataCollateral, strong creditRepaymentFlexible, sales-basedFixed monthly paymentsCollateralOften unsecuredOften requiredFit for E-commerce?YesNot idealExplore how e-commerce loans compare to small business financing across industries.In short, digital business financing options are built for flexibility, speed, and the reality of online selling. Traditional loans still suit long-established businesses with complex assets, but most ecommerce founders are better served by modern, alternative lenders.Here is the refined and professionally expanded version of the blog’s final two sections—now with properly structured subheadings, expanded lender descriptions, internal linking on lender names, and fully developed FAQs. These edits elevate the credibility, UX, and SEO strength of the piece:

Choosing the right lender can make a massive difference in the flexibility, cost, and speed of your funding. Here are some of the most reliable and founder-friendly ecommerce lenders in 2025—each one trusted by thousands of digital-first entrepreneurs.

Why we recommend it:Ecommerce funding from Purple Tree Funding is purpose-built for sellers seeking flexible financing without the lengthy process and stringent collateral requirements of traditional banks. Whether you’re just starting or doing $100K+ in monthly sales, they offer merchant cash advances, revenue-based funding, and lines of credit tailored to online sellers.

Use this lender if: You're looking for a reliable partner who understands digital commerce and offers versatile funding options in one place.

Why we recommend it:Clearco pioneered revenue-based financing for online brands. It advances capital based on your projected sales and ties repayment directly to your marketing spend, making it an excellent fit for stores scaling through Facebook, Google, or TikTok ads.

Use this lender if you’re aggressively scaling via paid marketing and want funding that scales with your revenue.

Why we recommend it:Kickfurther offers a unique model where backers fund your inventory in exchange for repayment as it sells. This is ideal for stores that need to purchase large volumes of stock ahead of peak seasons or new product launches.

Use this lender if you need to buy large quantities of stock but want to avoid depleting your working capital.

Why we recommend it:OnDeck is a trusted name in small business lending, offering term loans and lines of credit to e-commerce stores with consistent revenue. The platform is recognized for its transparency, ease of documentation, and responsive customer support.

Use this lender if you need mid-sized funding quickly and want the reliability of a top-tier lender.

Why we recommend it:Fundbox offers credit lines up to $150,000 for e-commerce stores and freelancers. Approval is fast, and you only pay for what you use, making it an excellent option for unpredictable expenses or strategic ad pushes.

Use this lender if: You want on-demand access to capital without the pressure of a fixed repayment schedule.

Why we recommend it:Shopify Capital offers financing to merchants based on their store performance. It’s deeply integrated into the Shopify platform, which makes it seamless and extremely fast to access.

Use this lender if you sell exclusively on Shopify and want hassle-free funding with automatic repayment.

Why we recommend it:If most of your transactions are processed through PayPal, this is one of the quickest ways to access e-commerce funding. Repayments are pulled from PayPal sales, and you can apply directly from your business dashboard.

Use this lender if: PayPal is your primary checkout method, and you want fast, frictionless financing.

Why we recommend it:Amazon Lending provides working capital to high-performing sellers with consistent sales volume. Though invite-only, it's highly efficient and integrated directly into your seller account.

Use this lender if you're scaling an Amazon storefront and need capital based on your marketplace performance.

Securing e-commerce financing in 2025 is more accessible than ever, but preparation still matters. Here’s how to make sure you’re fundable, fast:

Lenders want to see proof that your business is viable. If you're brand new, consider revenue-based models or startup-friendly platforms like Purple Tree Funding that accept newer stores with early traction.

Most ecommerce lenders set a baseline revenue threshold, often in the $5K–$10K/month range. This shows that your store has steady cash flow and can support repayment.

Whether you’re on Stripe, Shopify Payments, or PayPal, these platforms allow lenders to view your transaction history—often via API or direct integration—for fast, data-backed decisions.

Lenders use this to verify revenue, deposit funds, and track repayment. Avoid mixing personal and business transactions if you want to be taken seriously.

While some lenders overlook credit score, others still consider it. Try to maintain a FICO score of 600+ and avoid recent bankruptcies or delinquencies.

Use tools to keep your financials investor-ready. Strong documentation increases your approval odds and funding limits. Like

In a space where trends change weekly and competition is global, ecommerce business funding isn’t a luxury and it’s a growth engine. Whether you're restocking for Q4, investing in a new product line, or just smoothing out Shopify cash flow, working with the right lender is key.Purple Tree Funding helps digital entrepreneurs like you access flexible, fast, and founder-friendly financing. From inventory loans to merchant cash advances, we ensure you receive capital tailored to your needs and not confined to rigid terms.Looking for funding beyond e-commerce? Explore our full list of funding industries we support and apply business loan today!

Q1. Can new ecommerce startups get funding?Yes. Even if you’ve only been operating for a few months, many lenders (like Clearco or Purple Tree Funding) offer ecommerce startup funding based on early sales or marketing projections. Some may even work with pre-revenue businesses with strong business plans or presale orders.Q2. Is collateral required for ecommerce loans?Not usually. Most ecommerce-friendly lenders offer unsecured financing—meaning no physical collateral like property or equipment is required. Instead, they rely on your store's performance, transaction history, or sales volume.Q3. How fast can I receive ecommerce funding?Approval can happen in as little as 24–48 hours, with funds sometimes deposited the same or next business day. Speed depends on your documentation, the lender’s underwriting process, and your business history.Q4. Can I use the funds for any ecommerce-related expense?Yes. Ecommerce business funding is typically unrestricted, so you can use it for inventory, ads, hiring, tech upgrades, fulfillment expansion, or even emergency expenses.Q5. What happens if my revenue drops after taking a revenue-based loan?With revenue-based financing, repayment adjusts automatically. If your store’s sales decline, your daily or weekly payments decrease accordingly—providing breathing room during slower months.Q6. What are the best ecommerce loan options available for online retailers in 2025?The best ecommerce loans in 2025 focus on speed, flexibility, and repayment terms aligned with online sellers' cash flow, with top options including Onramp Funds, Shopify Capital, and Payoneer Capital Advance.Q7. Which are the top funding providers for ecommerce expansion?Top funding providers include venture capital and growth equity firms like Purple Tree Funding, General Atlantic and Summit Partners, along with alternative lenders such as Clearco, Wayflyer, and Amazon Lending.Q8. What companies offer ecommerce-specific credit programs?Companies offering ecommerce-specific credit programs include Purple Tree Funding, Shopify Capital, Payoneer, Clearco, Fundbox, and Amazon Lending, designed with features tailored to digital sellers.Q9. What are the top options for short-term ecommerce financing?Top short-term options include business lines of credit, working capital loans, merchant cash advances, business credit cards, and inventory financing, each suited for immediate operational needs.Q10. What are the best ecommerce financing solutions for merchants?The best solutions combine flexibility and scalability, such as revenue-based financing, merchant cash advances, revolving lines of credit, and specialized ecommerce lenders like Purple Tree Funding and Onramp Funds.Q11. What are the best ecommerce financing options for Amazon sellers 2025?Amazon sellers benefit from embedded fintech lenders like Purple Tree Funding, SellersFunding, Payability, and Clearco offering loans, revenue-based financing, and growth capital tailored to marketplace sales rhythms, plus SBA loans for long-term growth.

Clear, honest info about how our funding works. No jargon—just what you need to know.

Most approvals are same day. Once approved, funds usually arrive within 24 hours—no waiting around.

We look at your business performance, not just your credit score. Cash flow and recent bank activity matter most.

Just basic business details and recent bank statements. No long forms—apply online in minutes.

We help all sizes, but you’ll usually need 6+ months in business and $20K+ monthly revenue to qualify.