If you run a seasonal business—such as landscaping, snow removal, pool cleaning, holiday decorating, or tax preparation—managing cash flow throughout the year can be challenging. Revenue spikes during peak seasons and drops during off-peak months often leave business owners scrambling to cover expenses. Working capital loans for seasonal businesses are designed to bridge these gaps, keeping operations smooth and allowing your business to thrive year-round.

Let’s explore how seasonal business working capital loans can help your company navigate cash flow challenges and position itself for growth.

Seasonal businesses face unique financial challenges due to fluctuating revenue patterns. While the busy season may bring in a majority of annual income, expenses remain constant throughout the year. Working capital loans for seasonal businesses provide the funds needed to manage off-peak months, invest strategically, and prepare for upcoming peak periods.

Cash flow is the lifeline of any business, but for seasonal businesses, it can be especially tricky to maintain. Let's break down the two main phases these businesses face.

When demand spikes, businesses often find themselves scrambling to meet the increased need. Whether it’s more inventory, additional staff, or ramped-up marketing efforts, working capital loans can provide the cash flow for seasonal businesses to manage these demands.

In the off-season, business activity declines, which can create cash flow gaps. Rent, utilities, and payroll still need to be paid, but sales are down. Without sufficient funds, businesses risk falling into debt or even shutting down. Working capital loans help bridge these gaps, allowing businesses to stay operational even when cash flow is slow.Pro Tip: Seasonal businesses often struggle to maintain steady cash flow year-round. Exploring the right small business financing options can help address these challenges and plan for long-term growth.

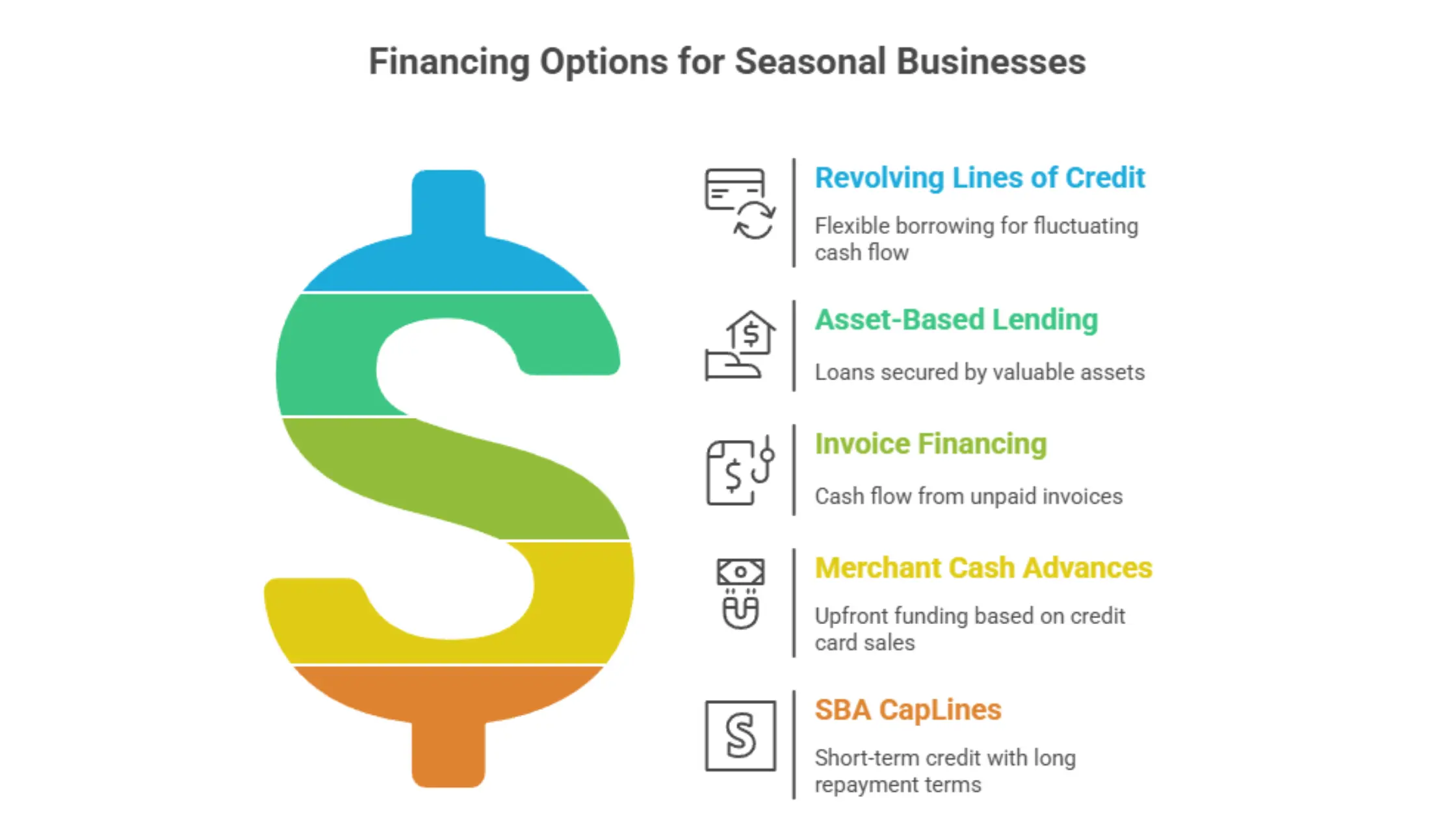

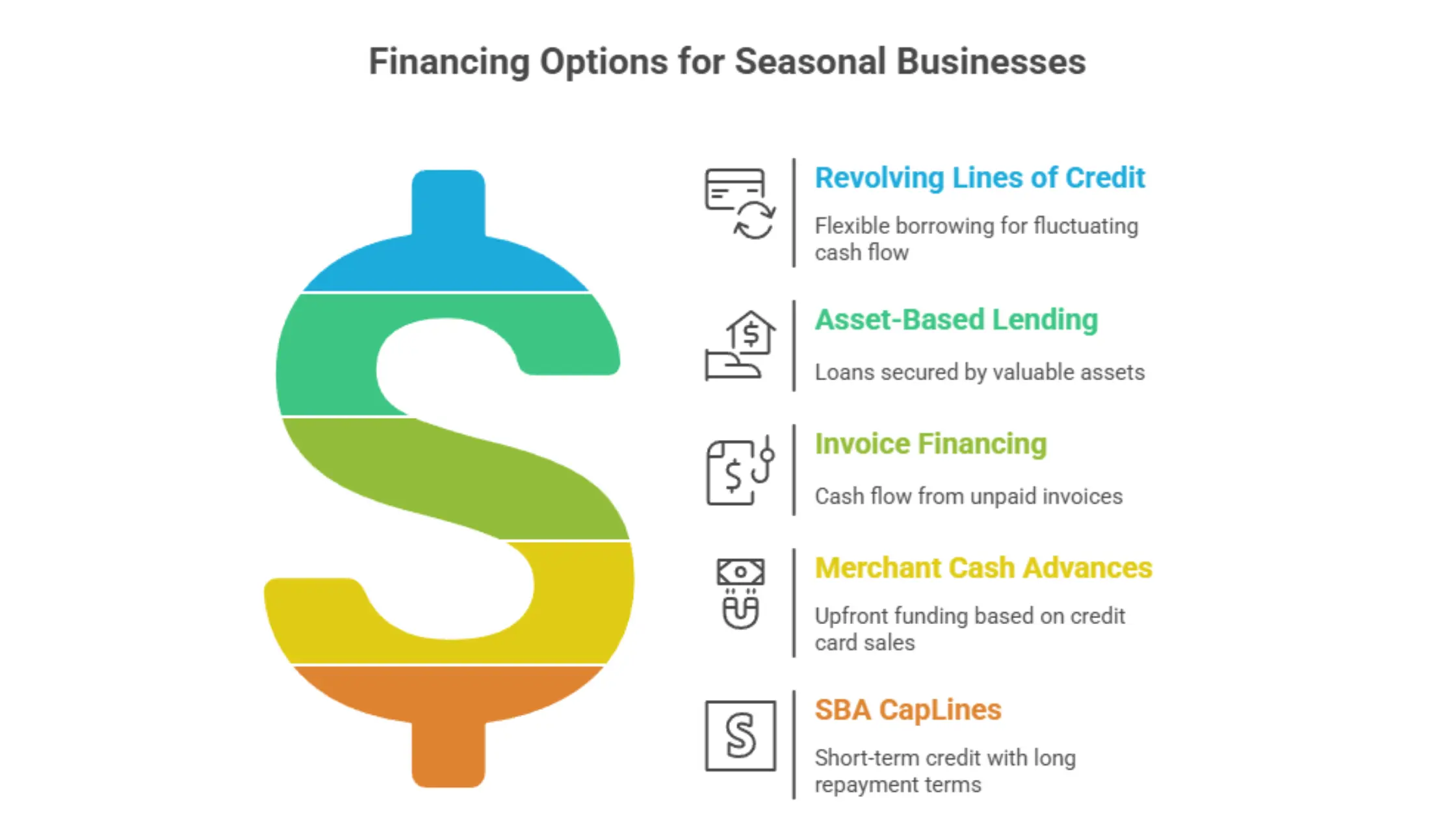

Understanding the right financing options can make a significant difference in maintaining stable operations. Here are some popular seasonal business loan types:

Revolving Lines of credit are a flexible option, allowing businesses to borrow as needed, repay the amount, and borrow again. It’s perfect for businesses with fluctuating cash flow, making it easy to access funds during slow seasons and repay once business picks up.

For businesses with valuable assets like accounts receivable or inventory, asset-based lending could be a smart choice. ABL loans are secured by assets, and businesses can borrow based on their current asset value, which is ideal for those with fluctuating inventory needs.

If your business faces long wait times for payments, invoice financing can release cash tied up in unpaid invoices. This allows businesses to maintain operations and cover expenses without waiting for customers to pay.

Designed for businesses with high daily transactions, such as retail or restaurants, merchant cash advances provide upfront cyclical business funding based on future credit card sales. It’s repaid through daily deductions, making it a great option for businesses with unpredictable cash flow.

The Small Business Administration (SBA) offers CapLines, which are ideal for short-term working capital needs. These lines of credit can help seasonal businesses with inventory buildup during busy seasons and have long repayment terms with competitive rates.If your seasonal business is digital or inventory-heavy, explore tailored e-commerce funding options that can support pre-season inventory buildup and marketing campaigns.

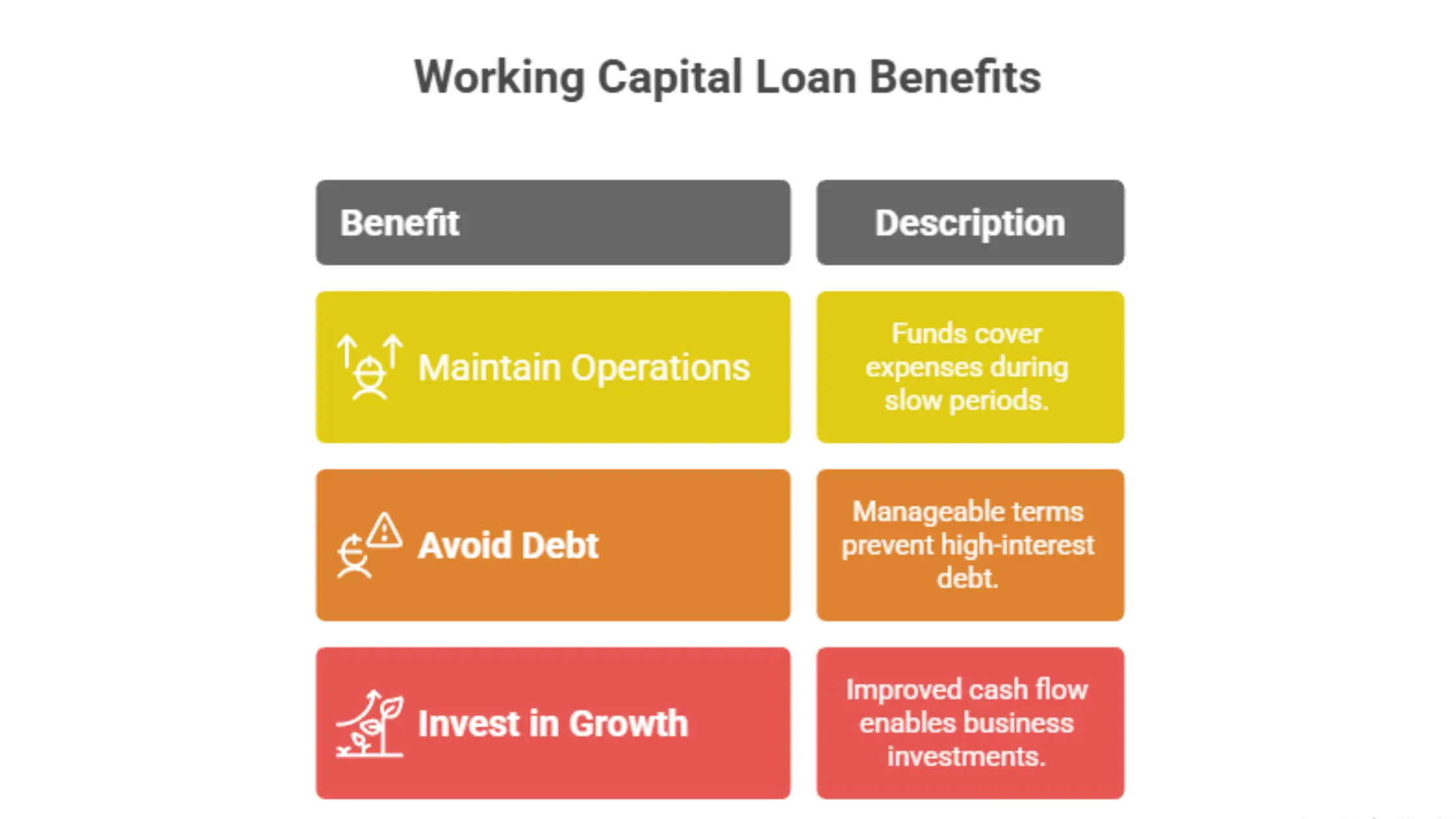

Working capital loans aren't just about managing slow periods. They offer several advantages that can help seasonal businesses succeed year-round:

Working capital loans offer the funds needed to cover expenses during off-peak times. Whether it's paying staff or covering fixed costs like rent, these loans keep businesses running smoothly even when sales are down.

Without access to working capital, seasonal businesses might resort to costly loans or high-interest credit cards. A working capital loan, with its manageable terms, helps businesses avoid accumulating debt and pay back loans in a timely manner.

With better cash flow, businesses can invest in growth opportunities like marketing campaigns, product development, or new equipment. By keeping operations running efficiently, working capital loans help seasonal businesses take advantage of growth prospects.

Before choosing a working capital loan, it’s important to assess your seasonal business’s unique needs and circumstances. Here are some factors to keep in mind:

Interest rates, repayment terms, and fees can vary significantly between lenders. Compare options to find a loan that offers favorable terms, taking into account your seasonal cash flow needs.

Lenders often require businesses to meet certain eligibility standards, such as a strong financial history and a clear plan for repayment. Make sure your business is eligible before applying.

Not all loans are created equal. Evaluate your specific needs, whether it’s covering inventory costs, paying employees, or investing in marketing. Choosing the right funding option can make all the difference in how well your business performs during each season.

Working capital loans provide the financial cushion seasonal businesses need to maintain operations during slow months and invest strategically before peak seasons. By improving cash flow and funding marketing or inventory in advance, these loans empower businesses to grow sustainably year over year.

By offering access to funds when needed most, offseason capital funding helps seasonal businesses manage cash flow gaps. Whether it's covering payroll during the offseason or ramping up operations for peak seasons, these loans make sure businesses can meet all their financial obligations and keep working year-round.

Without proper long-term or short-term funding, seasonal businesses may resort to debt that’s difficult to repay or fail to seize growth opportunities during peak times. By using working capital loans effectively, businesses can avoid these financial pitfalls.

With improved cash flow, businesses can use working capital loans to invest in things like product development, marketing, or staff training. These investments help businesses build a stronger foundation, positioning them for future growth and sustainability.

Seasonal businesses face high revenue volatility, making it crucial to manage cash flow effectively. Working capital loans for seasonal businesses provide the financial cushion needed to cover off-season expenses, invest in peak season preparation, and support long-term growth. With the right funding strategy, seasonal businesses don’t just survive—they thrive.

Partner with Purple Tree Funding to access seasonal business working capital loans designed to stabilize cash flow, support operations, and enable sustainable growth. Apply today and ensure your business stays ahead, no matter the season.

Q1: What is a seasonal business working capital loan?

A seasonal business working capital loan is short-term financing designed to help companies cover operational expenses during off-peak months and prepare for peak periods.

Q2: How can seasonal businesses use these loans during slow months?

Loans can cover fixed costs like utilities, rent, and payroll until revenue picks up in the busy season.

Q3: What types of seasonal working capital loans are available?

Popular options include revolving lines of credit, asset-based lending, invoice financing, merchant cash advances, and SBA CapLines.

Q4: Can these loans help with growth investments?

Yes, funds can be used for marketing, staff hiring, equipment upgrades, or inventory buildup to maximize seasonal opportunities.

Q5: How do seasonal businesses qualify for these loans?

Lenders typically assess financial history, business plan, seasonal cash flow patterns, and sometimes collateral. Alternative lenders may have flexible requirements.

Clear, honest info about how our funding works. No jargon—just what you need to know.

Most approvals are same day. Once approved, funds usually arrive within 24 hours—no waiting around.

We look at your business performance, not just your credit score. Cash flow and recent bank activity matter most.

Just basic business details and recent bank statements. No long forms—apply online in minutes.

We help all sizes, but you’ll usually need 6+ months in business and $20K+ monthly revenue to qualify.